how to calculate nj taxable wages

Once you report all of your income on your Form 1040 and Schedule 1 you will then have the chance to adjust your income on Schedule 1. Enter the FUTA taxable wages and the reduction rate see page 2.

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

202223 Georgia State Tax Refund Calculator.

. FUTA Taxable Wages. Box wages that were excluded from state unemployment tax see the instructions for Step 2. Calculate Deductions and Taxable Income.

Multiply the FUTA taxable wages by the reduction rate and enter the credit reduction amount. Calculate your total tax due using the GA tax calculator update to include the 202223 tax brackets. Deduct the amount of tax paid from the tax calculation to provide an example of your 202223 tax refund.

Click Calculate to see your tax medicare and take home breakdown - Federal Tax made Simple. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation. OrganBone Marrow Donation Deduction If you donated an organ or bone marrow to another person for transplantation you can deduct up to 10000 of unreimbursed expenses for travel lodging and lost wages related to the donation.

PO Box 957 Trenton NJ 08625-0957. Dont include in the. Complete Schedules NJ-BUS-1 and NJ-BUS-2 to calculate the amount of the adjustment or loss carryforward.

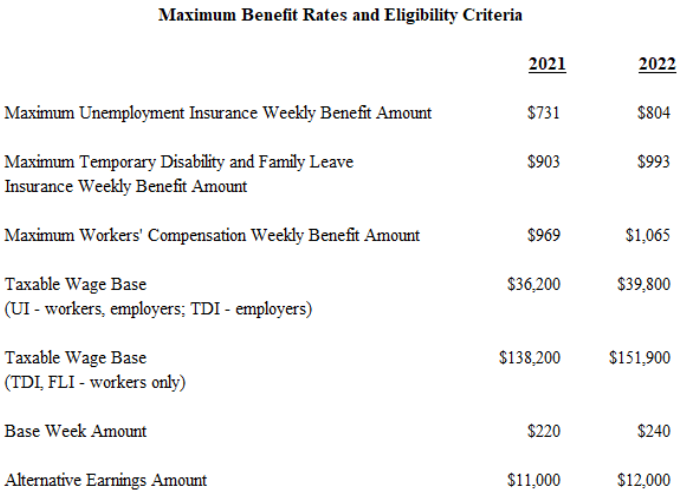

Many individuals have more than one employer and the law requires that wages from all base-year employers be used to calculate the benefit amount even if they are not the individuals last employer. The next question you should be asking yourself is How do I figure my taxable income This step will help you find your taxable income after deductions. If any states dont apply to you leave them.

Keep in mind any day that an employee receives full wages in paid time off or NJ Earned Sick Leave they cannot also receive Temporary Disability benefits. Type of federal return filed is based on your personal tax situation and IRS rules. Disability benefits are taxable under federal income tax and FICA Social Security.

This means that if an employee utilizes employer paid time off or NJ Earned Sick Leave first it will postpone Temporary Disability eligibility and may reduce the length of time an.

2022 Federal Payroll Tax Rates Abacus Payroll

![]()

New Jersey Paycheck Calculator 2022 With Income Tax Brackets Investomatica

State Corporate Income Tax Rates And Brackets Tax Foundation

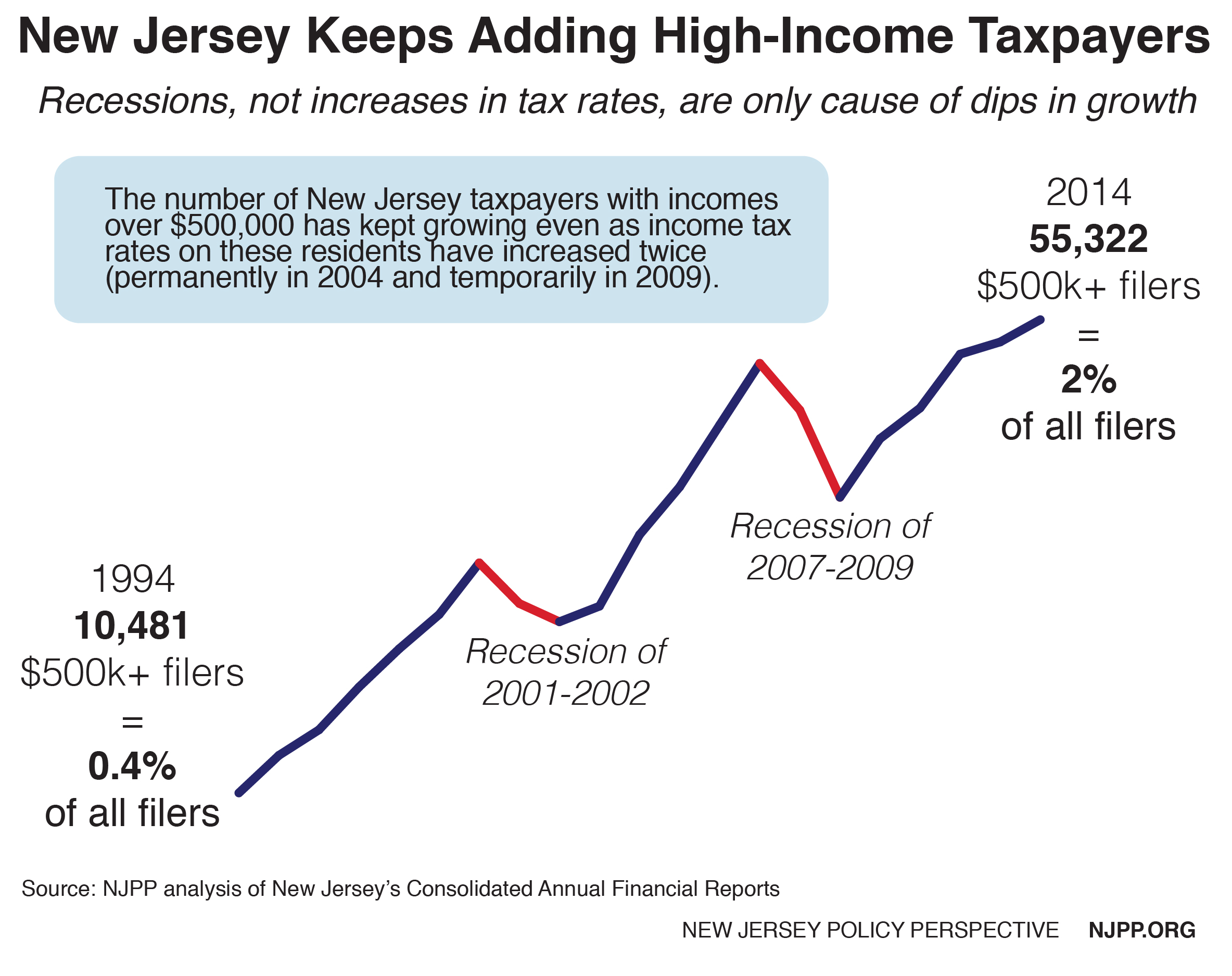

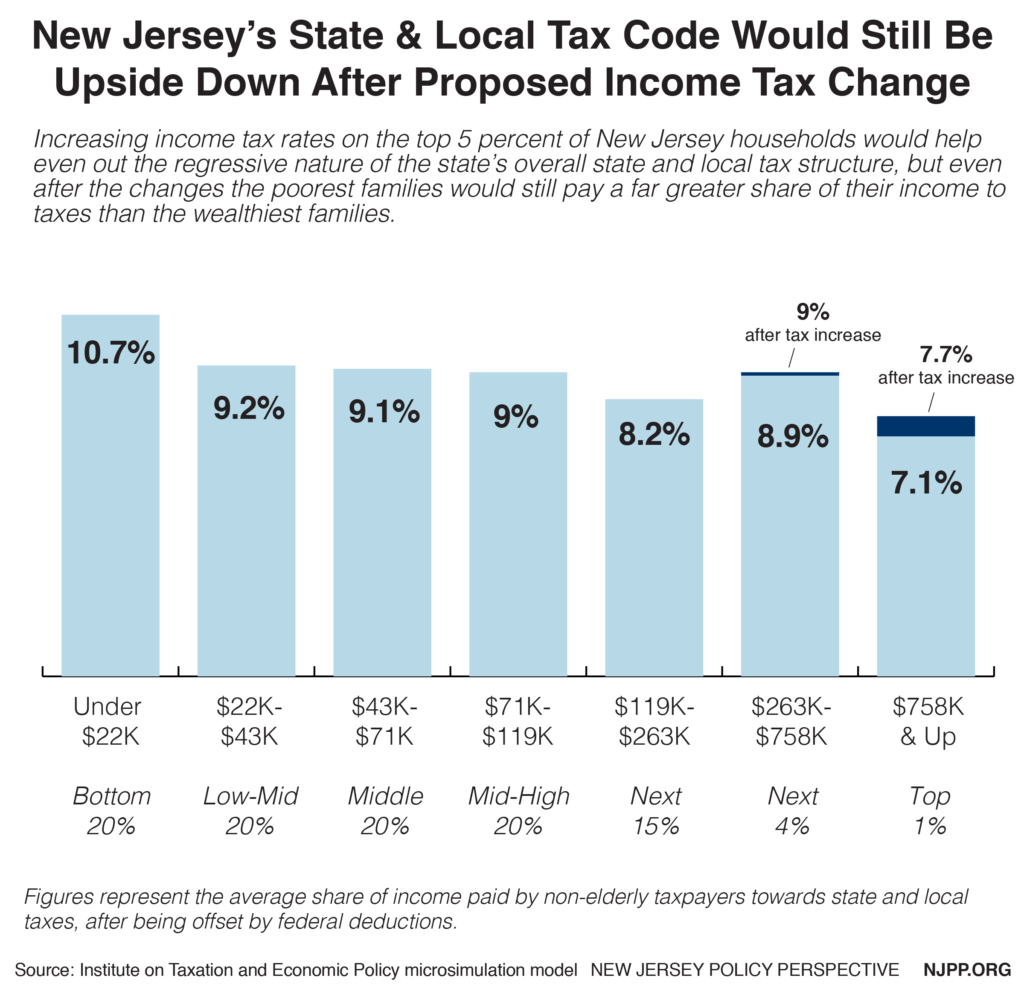

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

2021 New Jersey Payroll Tax Rates Abacus Payroll

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

New Jersey Nj Tax Rate H R Block

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Nj Takes Another Look At Tax Bracketing Nj Spotlight News

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

How Do State And Local Individual Income Taxes Work Tax Policy Center

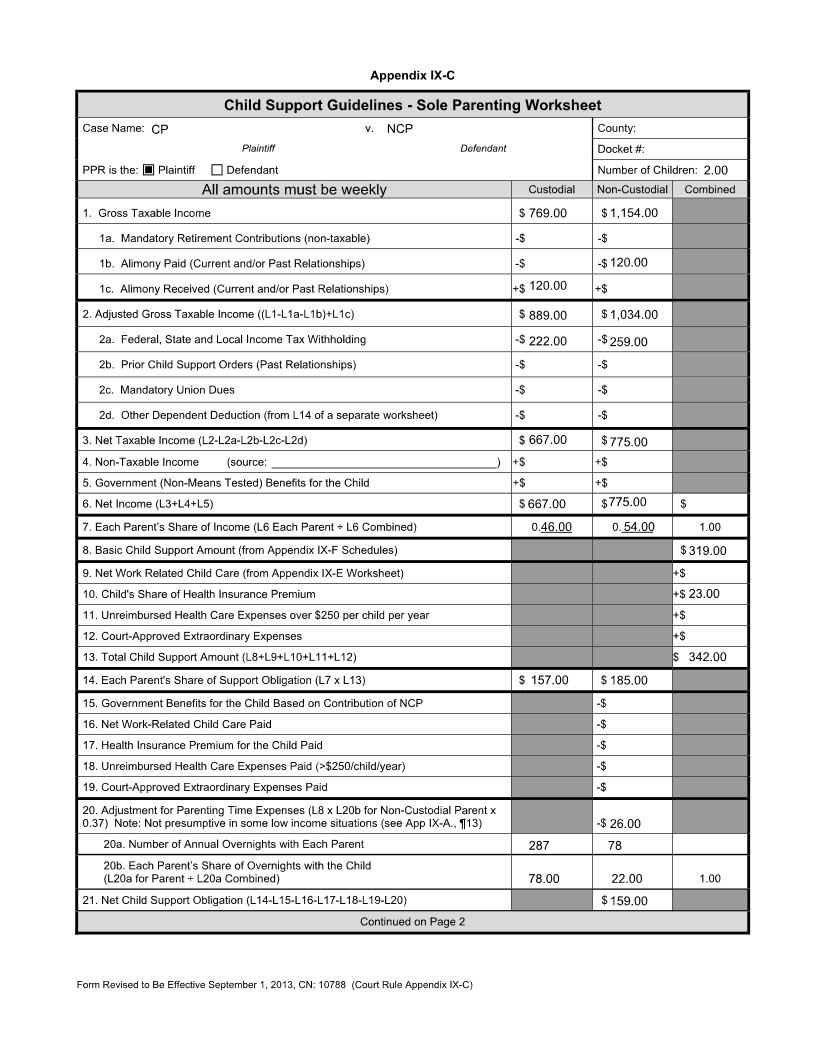

How Much Child Support Will I Pay In New Jersey

How To Complete Your Nj Tax Return In 5 Simple Steps Youtube